Have you ever needed to transfer funds over to friends or family but did not want to hassle with wiring fees or with sending in checks or cash deposits? Or have you ever wanted to split up a bill and have your friends pay you so you can reap the rewards with a great rewards credit card?

Chase QuickPay with Zelle is a great solution to these issues that allows you to freely transfer funds to different bank accounts.

In this article, I will tell you everything you need to know about Chase QuickPay, including how to enroll and how to send payments to recipients. I’ll also talk about things like the transfer limits and answer other common questions.

Table of Contents

Chase QuickPay is a feature that you can use online or through the Chase mobile app that allows you to send funds to other bank accounts and receive funds as well. It is an extremely convenient feature and is free to use so I highly recommended it to a lot of people.

In the middle of 2017, Chase revamped its QuickPay feature and now it is powered by Zelle. Zelle Pay allows you to transfer funds to other people who do not even have a Chase bank account. So now, Chase QuickPay is even more useful than ever.

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

If your friends or family do not bank with Chase, you can still use Chase QuickPay with them. They just need to sign up for person to person payments. Non-Chase customers can sign up with their bank’s person-to-person payment service or visit zellepay.com to sign up.

In addition to Chase, Zelle members include many major U.S. banks, such as:

There are also plenty of regional banks such as:

You can find the full list of eligible banks here. If your bank or credit union doesn’t offer Zelle yet, just download the Zelle app to get started.

To enroll in Chase QuickPay, head over to the Chase website here.

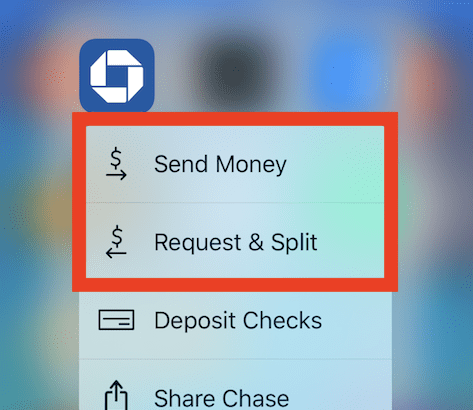

Once you are at that website, click on “Enroll in Chase QuickPay with Zelle.” You will then need to link your email address or your phone number to your Chase account in order to complete the enrollment process.

A security code will be sent to your phone or email account and then you will need to verify your account. Once you do that, you are ready to use Chase QuickPay.

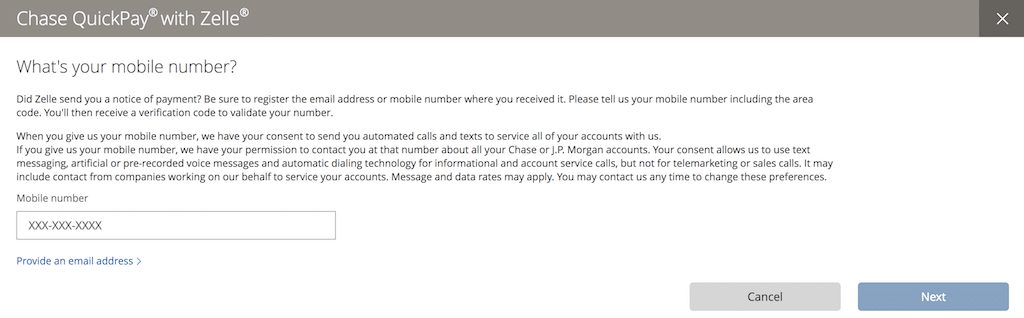

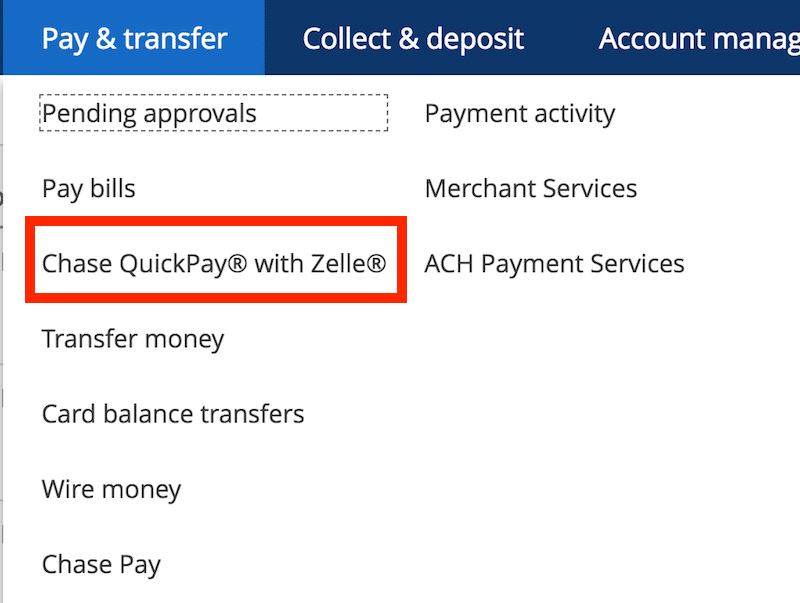

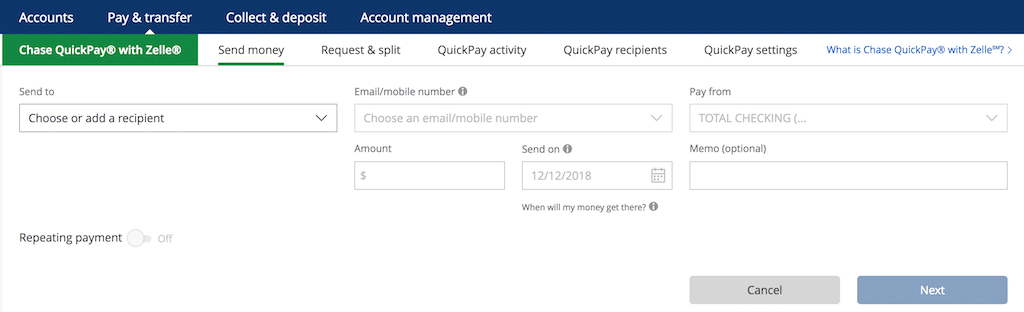

You can use Chase QuickPay either on the mobile app or through the website. If you are using it through the Chase website, then you just need to log in and then go to the top of your screen where you should see “Pay & Transfer.” Click on that and then click on Chase QuickPay with Zelle.

You will then be taken to a menu for Chase QuickPay that we’ll have options for you to manage your account.

You can choose to:

The request and split feature is pretty cool because you can select up to 15 recipients to split up payments with. You simply select their accounts and then input the total amount of money that you will be requesting from all of them. You can enter the amount of a bill and then request for the amount to be split evenly among all the recipients or you can request money from them individually.

If you are ready to send funds to a recipient then all you have to do is:

After you send a payment, the recipient should receive an email or text message telling them how to receive their payment. (Message and data rates may apply.)

Recipients who are new to Chase QuickPay must sign up first and verify the email address you used to send money. This should only take them a few minutes to do so it is a pain-free process.

However if they are not a Chase Customer then they will have to complete a few additional steps.

To add recipients to transact with, click on “QuickPay Recipients.” Then simply click on “add a recipient” and then input their information which will include either their phone number or their email address. You can also add up to 45 recipients to a group.

Note that the recipients will not see your personal banking details and you will not be able to see their details.

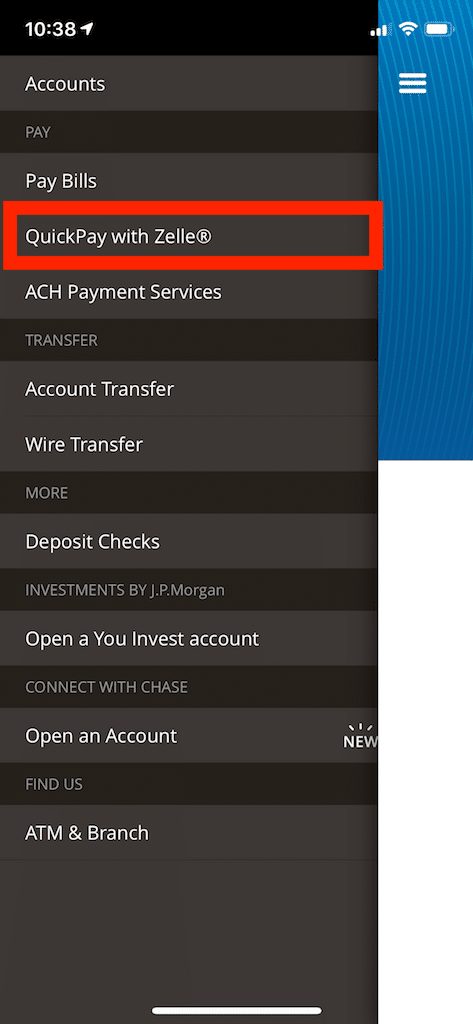

You can also use Chase QuickPay through the mobile Chase app. Be sure not to confuse Chase Pay with Chase QuickPay. Chase Pay is a separate mobile wallet app that allows you to have express checkout. Meanwhile, Chase QuickPay is a feature built into the main Chase mobile app. That means you do not have to download any additional app to use Chase QuickPay.

Once you log in to the mobile account, all you need to do is click on the three horizontal bars in the upper left corner of the app. You will then see the option for choosing “QuickPay with Zelle.” Once you click on that, you will see the options for sending money, requesting and splitting money, viewing your activity, and managing your recipients.

Sending money through the app involves the same process of inputting the amount you’re trying to send and selecting the bank account and the date

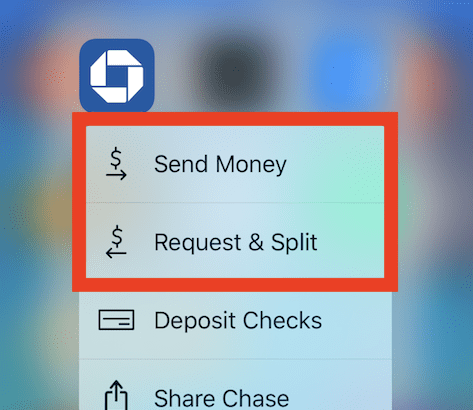

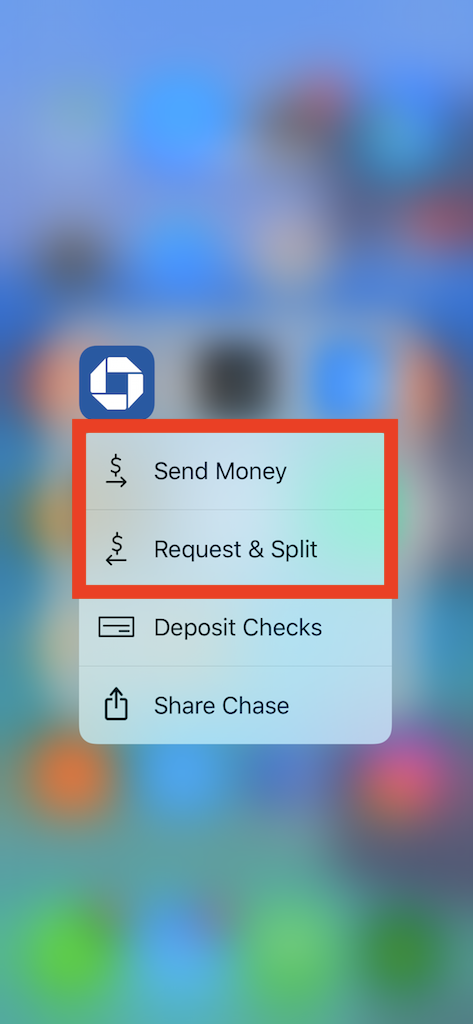

One interesting feature of the mobile app is that you can do a hard press on the icon of the Chase app, and pull up the send money and requests and split money Features for Chase QuickPay.

If you have an iPhone you might need to allow the Chase to access your contacts if you want to get full use out of the app. That will allow you to simply select from the list of contacts on your phone.

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

The transfer limits depend on what type of account you are sending funds from. Most people will probably be limited to $2,000 per transaction with a maximum of $2,000 dollars per day.

You may make transfers from External Accounts or consumer Chase checking accounts in amounts of up to $2,000 per transaction with a maximum of $2,000 per day, $8,000 in any seven (7) day period, and $16,000 in any thirty (30) day period, from all your combined accounts registered with Chase QuickPaySM.

You may make transfers from business Chase checking accounts in amounts of up to $5,000 per transaction with a maximum of $5,000 per day, $20,000 in any seven (7) day period, and $40,000 in any thirty (30) day period, from all your combined accounts registered with Chase QuickPay.

If you are a Private Banking client, transfers may be made in amounts of up to $5,000 per transaction with a maximum of $5,000 per day, $8,000 in any seven (7) day period, and $16,000 in any thirty (30) day period, in the aggregate from all your combined accounts registered with J.P. Morgan QuickPay.

If your recipient is another Chase customer or their bank is a Zelle member and supports real-time payments, they’ll typically get their money within minutes. For the quickest results, make sure that they accept the payment before 10 PM EST.

Being able to send virtually instant payments is great for those people who you may not always necessarily trust 100% that they will get their funds over to you so you can use this for your friends that are a little on the “shady” side.

If you are sending funds from a Chase account to a non-Chase account, then it could take 1-2 business days after the business day that the recipient accepts, subject to the processing times of their bank. For the quickest results, make sure that they accept the payment before 8 PM EST.

If you have funds coming in from a non-Chase account into a Chase account then it could take 4-5 business days after the business day the recipient accepts. For the quickest results, make sure that you accept the payment before 8 PM EST.

The recipient will have 10 days to accept the payment. If the payment is not accepted within 10 days then the transaction will be canceled and the money will be refunded.

No, these transactions can only be done with U.S. banks.

Venmo and PayPal are two other popular ways to send payments to other people. Those services will charge a transaction fee of 2.9% or 3% for credit card transactions. With QuickPay, you may only make a credit card payment when paying an invoice to a business Managing Chase QuickPay who accepts credit cards through Chase QuickPay

You can only cancel a payment if the recipient hasn’t yet enrolled with Zelle. If they are already enrolled then that means that the transaction will likely be completed and your only way to get the funds back is to ask them to send the funds back to you.

If you have more questions about Chase QuickPay then you can click here.

Chase QuickPay is a great feature for easily moving around funds. It makes it really easy to make transfers between family and friends and to do things like split up payments and bills for dining and other activities.

If you have friends who are willing to split the bill or tab with you then you should consider putting the entire bill on a great rewards card like the Sapphire Preferred or Sapphire Reserve which earns bonus points on things like dining and travel.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.